In this article

- How Capital Analytics Reveals What Traditional CapEx Reporting Can’t See

- The Three Financial Pillars of Capital Analytics

- Beyond Financials: Measuring Strategic and Non-Financial Impact

- Integrating CapEx and OpEx: Seeing the Total Cost of Ownership Clearly

- The Cross-Functional Ripple Effects of Capital Investments

- Portfolio Dynamics: How Changes Cascade Through Value Realization

- Sensitivity Analysis: Confidence Levels for Smarter Decisions

- Why Many Organizations Aren’t Leveraging Capital Analytics Yet

- How Integrated Systems Make Capital Analytics Possible

- ROI Measures are Key to Capital Planning and Project Portfolio Management

- FAQs on Capital Analytics

In this article

- How Capital Analytics Reveals What Traditional CapEx Reporting Can’t See

- The Three Financial Pillars of Capital Analytics

- Beyond Financials: Measuring Strategic and Non-Financial Impact

- Integrating CapEx and OpEx: Seeing the Total Cost of Ownership Clearly

- The Cross-Functional Ripple Effects of Capital Investments

- Portfolio Dynamics: How Changes Cascade Through Value Realization

- Sensitivity Analysis: Confidence Levels for Smarter Decisions

- Why Many Organizations Aren’t Leveraging Capital Analytics Yet

- How Integrated Systems Make Capital Analytics Possible

- ROI Measures are Key to Capital Planning and Project Portfolio Management

- FAQs on Capital Analytics

Capital investments shape far more than cost performance; they influence how an organization grows, competes, and adapts. Yet most reporting still centers on budget position, which captures only a narrow slice of what an investment is meant to achieve.

This gap is why many organizations are strengthening their capital management analytics capability to move beyond cost tracking and understand the real value their portfolio is expected to deliver.

Capital Analytics brings this broader perspective into focus by shifting the conversation from cost to ROI and value creation. It gives executives clearer visibility into how each initiative contributes to performance today and how it positions the organization for tomorrow.

When project, financial, and strategic data come together, executives gain a more complete understanding of value drivers such as timing, benefits, risks, and strategic alignment.

This blog examines how Capital Analytics exposes the value flows, assumptions, and sequencing effects that traditional CapEx reporting often overlooks. It also complements wider practices like project forecasting, which helps executives anticipate how investments are likely to perform under different conditions.

Why the Emphasis on ROI?

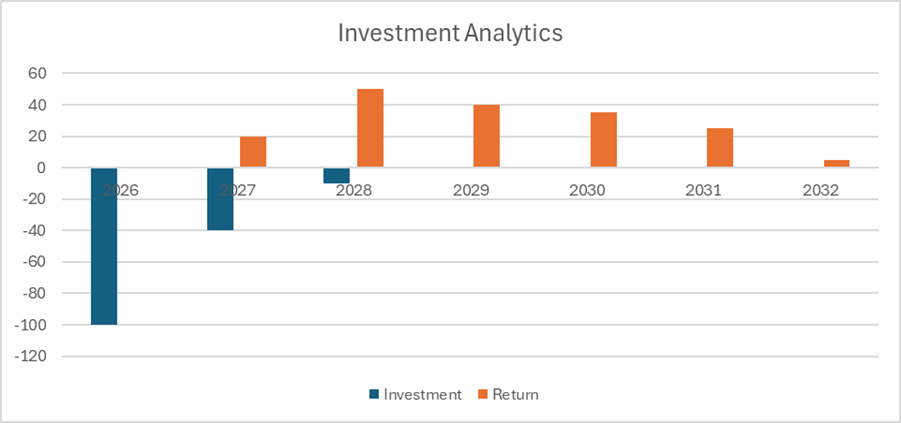

ROI represents the relationship between Return (revenue uplift or cost savings) and Investment. Both sides matter.

Return can be increased by enhancing benefits, while investment can be optimized by managing cost and timing. Capital Analytics consolidates these “return promises” across the portfolio and links them to the capital required to achieve them, helping executives see the real value and sensitivity of their future results.

Portfolio investment and returns, illustrating how Capital Analytics links CapEx timing to long-term ROI realization.

How Capital Analytics Reveals What Traditional CapEx Reporting Can’t See

Traditional CapEx reporting is designed to answer one core question: How are we tracking against budget? While essential for governance and control, it provides only a partial view of performance, not the value an investment is intended to create.

Capital Analytics expands that view. Instead of focusing only on cost performance, it connects financial outcomes with timing, benefits, risk, and strategic intent. This broader perspective helps executives understand not just whether a project is on budget, but whether it is delivering the outcomes that matter most to the organization.

Where traditional CapEx reporting isolates numbers, Capital Analytics highlights the relationships behind them; showing how an initiative influences profitability, operational performance, strategic positioning, and organizational resilience. It surfaces patterns and cause–effect dynamics that cost tracking alone cannot reveal.

By shifting the focus from cost to value, Capital Analytics enables executives to make more informed decisions about prioritization, timing, trade-offs, and portfolio balance.

The Three Financial Pillars of Capital Analytics

Capital Analytics brings together the financial picture of each initiative; not just what it costs, but how it affects profitability, the balance sheet, and cash flow over time. Understanding these three dimensions together is essential for accurate ROI assessment.

1) Profit & Loss (P&L) Impact

P&L outcomes represent the most visible contribution an investment makes to organizational performance. These include:

- Revenue generated or protected

- Cost savings delivered

- Depreciation effects (often misunderstood but hugely influential)

Depreciation is a key example of how accounting treatment can shape perceived returns. Asset classification, useful life assumptions, and depreciation rules can significantly distort reported profitability even when underlying cashflow remains unchanged. Capital Analytics helps executives see through these accounting effects, so projections are grounded in economic reality, not just technical treatment.

A well-known market example helps illustrate the impact of depreciation assumptions:

Investor Michael Burry has warned that major AI companies may be overstating earnings by extending the depreciable life of AI chips beyond what rapid innovation cycles justify. If hardware becomes obsolete faster than assumed, reported profits can appear healthier than the underlying economics support.

While market analysts debate the specifics, the core point is clear: depreciation assumptions materially influence reported results, and Capital Analytics helps organizations understand these sensitivities rather than relying solely on headline profit figures.

2) Balance Sheet Impact

CapEx directly reshapes the structure of the balance sheet:

- Cash converts to fixed assets

- Liquidity ratios shift

- Funding choices alter leverage and capital structure

Boards pay close attention to these effects because they influence valuation, borrowing capacity, and investor expectations. A project may look favorable from a P&L perspective yet place pressure on balance sheet ratios and vice versa. Capital Analytics helps executives evaluate these outcomes together, so financial strength is considered alongside financial performance.

3) Cash Flow Impact

Cash flow reflects the real timing of financial commitments and benefits. Key drivers include:

- The phasing of capital payments

- Jurisdiction-specific tax treatments (e.g., immediate expensing in the US)

- Timing mismatches between cash flow and depreciation

Even when long-term returns are attractive, cash flow constraints can alter when or whether an initiative should proceed. Capital Analytics clarifies how investments affect cash position over time and highlights where timing adjustments might strengthen value realization.

A Full Financial Impact Picture

Individually, P&L, balance sheet, and cash flow each reveal part of an investment’s story. ROI Capital Analytics brings them together so executives can see the total financial effect of their capital portfolio.

This matters because decisions that improve one dimension often influence another:

- A favorable depreciation profile may strengthen earnings while reducing short-term tax benefits

- Deferring CapEx may support cash flow but delay value realization

- Accelerating a project may improve long-term competitiveness but temporarily shift balance sheet ratios

Capital Analytics links these interactions (costs, timing, accounting treatment, tax effects, and funding choices) into one connected view.

Beyond Financials: Measuring Strategic and Non-Financial Impact

Capital investments increasingly carry expectations that extend well beyond financial return. Organizations are now judged not only on profitability but also on their ability to advance strategic commitments such as emissions reduction, safety, resilience, service quality, and long-term community impact.

Capital Analytics makes Non-Financial Outcomes Visible

By connecting financial, operational, and strategic data, it allows executives to quantify and track non-financial benefits alongside traditional ROI measures. Essential for investments such as digital transformation, decarbonization, modernization and infrastructure renewal, where much of the value may not appear on a P&L.

These benefits can take many forms, including:

- Emissions reductions that support sustainability targets,

- Safety improvements that reduce organizational risk,

- Increased reliability or service quality that strengthens customer trust,

- Resilience investments that protect long-term operational continuity.

These outcomes influence reputation, regulatory obligations, stakeholder confidence, and competitive position. Yet they often sit outside traditional cost and schedule reporting.

Capital Analytics integrates these strategic outcomes with financial performance, helping executives understand how an initiative contributes to broader organizational goals and ensure that value is recognized even when it isn’t purely financial.

Integrating CapEx and OpEx: Seeing the Total Cost of Ownership Clearly

Capital investments create value over time, but they also introduce operating costs that determine the true lifecycle cost of each asset. When CapEx and OpEx are assessed separately, projects can appear favorable upfront while carrying long-term burdens that dilute expected returns.

Capital Analytics brings these accounting classifications together by combining:

- Immediate non-capitalized project costs such as early operating expenses, set-up, commissioning, or resourcing outside the capital budget.

- Long-term operating costs including maintenance, energy, consumables, licensing, and staffing for the life of the asset.

Viewing CapEx and OpEx in one model ensures business cases reflect realistic operating requirements, not just capital outlay. It strengthens lifecycle cost assessment by showing:

- how timing affects long-term cost commitments

- how operating expenses influence ROI across the asset’s useful life

- where cost drivers may shift as technologies or usage patterns evolve

Integrating CapEx and OpEx through Capital Analytics gives executives a clearer view of total cost of ownership, helping ensure investments deliver sustainable value—not just short-term appeal.

The Cross-Functional Ripple Effects of Capital Investments

Capital investments rarely affect only one team. Even when one function owns the business case, the impacts often extend across the organization. Anticipating these ripple effects early enables better planning and alignment.

A single capital investment can influence:

- HR: role changes, reskilling needs, new competencies (e.g., EV fleets reduce the need for diesel mechanics)

- Procurement: supplier ecosystem changes, new material requirements, updated contract structures

- Maintenance: different service cycles, spare parts, condition-based monitoring needs

- Customer service: improved reliability, faster delivery, or changing service expectations

- Operations: throughput impacts, safety requirements, new workflows, or equipment handling

- IT: integration needs, data requirements, cybersecurity considerations, licensing implications

- Environmental teams: emissions profiles, energy usage, waste management, water consumption

Most organizations never see these downstream impacts clearly until they feel the pain; resource bottlenecks, unbudgeted operating costs, strained processes, or misaligned priorities.

Capital Analytics brings these cross-functional implications into view before decisions are made. By understanding how one investment touches multiple parts of the organization, executives can plan more effectively, align stakeholders earlier, and ensure projects deliver the intended value without unintended friction.

Portfolio Dynamics: How Changes Cascade Through Value Realization

Capital project portfolios are dynamic. As market conditions and operational constraints change, project timing and sequencing also shift. These adjustments can materially influence portfolio value.

Understanding how these timing changes cascade through value realization helps leaders make more informed decisions.

Rather than viewing changes as isolated scheduling decisions, it highlights how:

- Bringing a project forward accelerates benefits but may increase short-term resource pressure

- Deferring a project protects cash flow but delays value and may impact competitiveness

- Re-sequencing related initiatives affects dependencies, risk exposure, and expected outcomes

- Advancing regulatory or strategic projects alters the timing of benefits across the wider portfolio

This visibility prompts executives to ask forward-looking, value-oriented questions, such as:

- How does adjusting timing influence revenue or cost-saving forecasts?

- What is the portfolio-wide impact of accelerating or delaying key initiatives?

- How do timing shifts affect resilience, risk concentration, or capacity?

- Are benefits still aligned to strategic priorities if sequencing changes?

Capital Analytics reframes scheduling decisions as value decisions, showing how the movement of one initiative influences financial, operational, and strategic outcomes across the broader portfolio.

This dynamic view supports continuous refinement. As conditions evolve, executives can adjust the portfolio with confidence. This ensures that timing, resourcing, and sequencing stay aligned to both near-term priorities and long-term organizational goals.

Sensitivity Analysis: Confidence Levels for Smarter Decisions

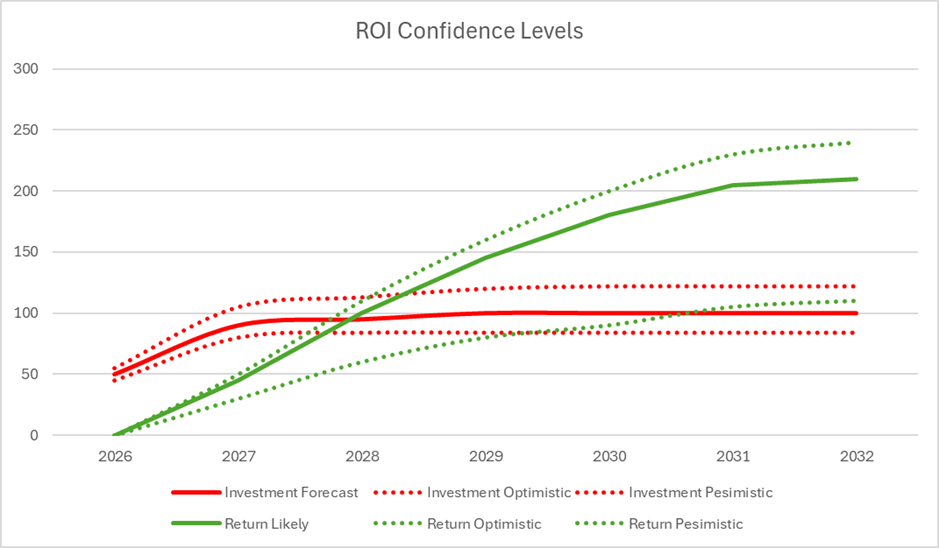

Capital planning always involves uncertainty. Sensitivity analysis helps executives understand how changes in key assumptions (costs, timelines, demand, or external conditions) affect expected ROI and value outcomes.

Sensitivity analysis illustrating ROI confidence levels. Capital Analytics models optimistic, likely, and pessimistic assessments to show how shifts in assumptions influence expected outcomes.

By applying consistent modelling assumptions across all initiatives, Capital Analytics provides a comparable, unified view of volatility and risk. It enables executives to:

- see which projects carry greater uncertainty

- understand where portfolio-level risks may compound

- identify areas requiring closer monitoring

- priorities initiatives with clearer confidence

With visibility into both expected outcomes and their degree of certainty, executives can make decisions grounded in realistic expectations rather than static, optimistic forecasts. Sensitivity analysis ultimately strengthens capital planning by revealing not just what the project portfolio may deliver, but how confidently those outcomes can be achieved.

Why Many Organizations Aren’t Leveraging Capital Analytics Yet

Many organizations want deeper insight into capital performance, but their planning processes were built primarily for governance and budgeting, not value modelling. Responsibilities sit across finance, engineering, PMOs, strategy, and operations, each using different tools and assumptions. These insights are valuable individually but rarely converge into a single view of value.

As a result, organizations default to familiar routines like budget tracking, cost reviews, and delivery reporting. These activities remain essential, but they don’t show how investments contribute to long-term outcomes or portfolio-wide value.

The opportunity is not to replace these practices but to connect them. When insights from different functions are integrated into one view, executives gain clarity that traditional reporting cannot provide. Early adopters of this approach often report:

- Stronger visibility across the portfolio

- Faster agreement on priorities

- Clearer understanding of trade-offs

- Greater confidence in capital decisions

Once organizations begin aligning data, assumptions, and expectations, value modelling becomes a natural evolution rather than a disruptive shift.

How Integrated Systems Make Capital Analytics Possible

Capital Analytics relies on visibility across business cases, financial models, schedules, benefits, risks, and operating assumptions. Most organizations already hold this information, but it sits in disconnected tools and functions. Integrated systems bring these components together, creating the foundation for portfolio-wide insight.

By linking CapEx and OpEx data, timing, classifications, and assumptions in a single model, updates flow consistently across every initiative. Executives can see how decisions or changes affect value at both the project and portfolio level without reconciling spreadsheets or navigating conflicting versions.

Platforms like Stratex Online enable this approach by centralizing business case analysis and ensuring:

- Consistent metric calculations across every initiative

- Standardized assumptions for benefits, costs, and timing

- Governed change control, with access security and audit trails

- Integrated actuals, sourced directly from financial systems

Combining planned value with actual investment performance allows organizations to actively monitor:

- Whether actual costs remain in line with approved budgets

- Whether benefits are tracking to value expectations

This enables critical decisions such as:

- Stopping failing projects early

- Reallocating time and money to higher-value initiatives

- Identifying when assumptions have shifted and value has eroded

A common breakdown in organizations is the lack of reconciliation between project performance and the original business case. Without visibility of how assumptions change, requests for budget supplements or extended timelines may be inappropriately approved even when an investment no longer delivers the required return.

A practical use-case of integrated systems:

A business decides to replace ageing machinery supporting an existing product line. Midway through the investment, technological change or competitive behavior renders the product economically unviable. Capital Analytics would flag that the original return assumptions no longer hold. Even if the project is on time and on budget, the correct decision may be to stop the investment because the future returns no longer justify continued spend.

This is the power of integrated systems: they turn static business cases into living, continuously updated views of value.

ROI Measures are Key to Capital Planning and Project Portfolio Management

Modern capital planning depends on understanding not just what projects cost, but what they create. ROI-focused Capital Analytics turns business cases into living models of value, helping leaders see sooner where returns are strengthening, weakening, or shifting altogether.

When organizations work from a consistent foundation of assumptions, schedules, costs, and benefits, decisions become faster and clearer. Leaders can adjust timing, redirect resources, or stop low-value work with confidence.

Strengthening ROI insight is about creating a connected view of value that guides every stage of the capital lifecycle. For organizations looking to sharpen their investment decisions, ROI-driven Capital Analytics offers a practical, integrated way forward.