In this article

- Why AI Investment Decisions Are No Longer Optional

- Why AI Investments Require a New Capital Evaluation Approach

- The Leadership Reality Behind AI CapEx Decisions

- The New CapEx Challenge: Making AI Comparable

- The CapEx Evaluation Dimensions AI Investments Bring Into Focus

- How Capital Ranking Changes When These Dimensions Are Included

- A Simple Illustration: When the Same Investment Is Evaluated Differently

- What Confident Capital Investment Decisions Look Like as AI Investments Become Standard

- FAQs on How CapEx Decisions Are Evaluated for AI Investments

In this article

- Why AI Investment Decisions Are No Longer Optional

- Why AI Investments Require a New Capital Evaluation Approach

- The Leadership Reality Behind AI CapEx Decisions

- The New CapEx Challenge: Making AI Comparable

- The CapEx Evaluation Dimensions AI Investments Bring Into Focus

- How Capital Ranking Changes When These Dimensions Are Included

- A Simple Illustration: When the Same Investment Is Evaluated Differently

- What Confident Capital Investment Decisions Look Like as AI Investments Become Standard

- FAQs on How CapEx Decisions Are Evaluated for AI Investments

AI is already embedded in many of the capital investments organizations are being asked to approve, including equipment, automation, optimization, and control systems. These are no longer ‘technology decisions’ or ‘innovation initiatives’. They are mainstream capital investments with material operational impact.

Leaders are therefore expected to evaluate, compare, and prioritize AI-enabled initiatives with the same discipline applied to other CapEx decisions, even though the processes and capital planning systems supporting those decisions have not always evolved at the same pace.

Yet AI investments change the underlying dynamics of capital decisions. They alter the sources of value, the structure of costs, the profile of risk, and the timing of returns.

As a result, capital decisions increasingly feel harder to rank and defend. Not because AI initiatives are unclear, but because the evaluation lens has not fully caught up.

This article examines how capital investment decisions need to be evaluated as AI becomes embedded in mainstream CapEx, and what leaders should expect to consider in order to compare, rank, and defend these investments with confidence.

Why AI Investment Decisions Are No Longer Optional

AI investment decisions are increasingly driven by competitive and operational pressure rather than innovation agendas. Organizations are responding to shifts in cost structures, service expectations, productivity benchmarks, and resilience requirements as the operating environment changes around them.

In many cases, AI-enabled initiatives are now required simply to maintain parity. Investments are made to keep pace with industry norms, regulatory expectations, or customer standards, rather than to deliver overt innovation.

Choosing not to invest is itself a strategic decision. Inaction can lead to higher operating costs, slower response times, reduced flexibility, or growing dependence on manual or fragmented processes. These consequences may not be immediate, but they are material.

The risks associated with delay tend to be cumulative rather than sudden. Capability gaps widen, data limitations persist, and skill constraints deepen over time, making later intervention more complex, expensive, and disruptive than earlier action.

AI investments are both defensive and offensive. Many initiatives are intended to reduce exposure to operational risk, safety incidents, workforce constraints, or supply disruption, even where direct financial returns are modest or hard to isolate.

As a result, timing becomes a critical dimension of the decision. Leaders must weigh not only whether to invest, but when – balancing organizational readiness, external pressure, and the cost of waiting.

Capital evaluation therefore needs to reflect urgency alongside return. Decisions increasingly involve assessing time sensitivity and strategic necessity, not just financial attractiveness.

Why AI Investments Require a New Capital Evaluation Approach

AI-enabled investments often combine physical assets, software, data, and operating processes into a single initiative. They do not align neatly with traditional capital categories and are better understood as integrated capabilities rather than standalone assets.

Cost structures extend beyond initial acquisition. Ongoing costs related to operation, scaling, improvement, governance, and support are part of the investment reality, reflecting how value is sustained over time.

Value is generated across systems rather than within a single asset. Benefits emerge from the interaction of people, processes, data, and other technologies working together to deliver outcomes.

Performance and outcomes tend to evolve rather than remain fixed. Many AI investments improve through use, refinement, and organizational learning: meaning early performance does not always reflect longer-term impact.

Impact often increases as initiatives are scaled or reused. The value of an AI-enabled capability is often tied to how broadly it can be applied across activities, locations, or functions over time.

These investments also contribute to long-term capability, not just immediate outputs. They shape operating models, decision quality, and future options beyond the original business case.

Taken together, these characteristics do not make AI investments inherently better or riskier than other forms of capital. They simply mean that AI-enabled initiatives behave differently when evaluated through traditional capital lenses, a challenge increasingly recognized in discussions around AI in CapEx.

The Leadership Reality Behind AI CapEx Decisions

AI CapEx decisions are made in highly visible environments. They are reviewed, questioned, and revisited by executives, boards, regulators, and operational leaders, often long after the initial approval.

CapEx decisions must stand up across functions. Finance, operations, technology, risk, and people leaders approach the same investment with different perspectives, assumptions, priorities and success criteria, increasing scrutiny rather than reducing it.

Accountability extends well beyond the moment of approval. AI-enabled initiatives continue to evolve after deployment, keeping decision-makers tied to outcomes that change as capability matures and usage expands.

As a result, the need to explain decisions does not end once funding is approved. Leaders are often asked to justify why an investment was prioritized, deferred, or sequenced, sometimes years later under very different conditions.

In this context, precision alone does not create confidence. Over-detailed forecasts or narrow metrics can obscure judgement rather than strengthen it when outcomes are uncertain or evolving.

Confidence instead comes from coherence. Decisions feel defensible when the rationale is clear, consistent, and aligned to strategic intent, even as results shift over time.

AI investments heighten this accountability. As systems learn, scale, and adapt, leaders remain responsible for decisions whose impact unfolds gradually rather than at a single point in time.

The New CapEx Challenge: Making AI Comparable

AI-enabled initiatives rarely exist in isolation. They are usually evaluated alongside non-AI alternatives that aim to achieve the same business outcome, whether through different technologies, processes or operating models.

CapEx decisions therefore still require comparison, ranking, and prioritization. Leaders must decide between AI-enabled options and more traditional approaches using a shared decision framework, even when the nature of those initiatives differs significantly.

Difficulty arises when evaluation criteria do not fully reflect how AI initiatives behave. Important aspects of cost, value, risk, and timing may be under-represented or invisible within the comparison.

In these conditions, AI initiatives can appear disproportionately risky. Particularly when benefits are distributed across business units, realized over the long-term, or dependent on scale and adoption.

Alternatively, AI initiatives can appear artificially attractive. Especially when qualitative benefits or future potential are overstated without sufficient context or balance.

Neither outcome supports confident decision-making. The issue is not the quality of the initiative itself, but the limitations of what is being compared.

The challenge for leadership is therefore comparability, not justification: making different types of initiatives visible and assessable on fair, consistent terms.

The CapEx Evaluation Dimensions AI Investments Bring Into Focus

AI investments shift attention from inputs to outcomes. What matters is not the technology itself, but how it affects operational performance, reliability, quality, safety, and flow across the organization.

Evaluation therefore must extend beyond upfront cost to lifecycle commitment. Ongoing cost, effort, and dependency are inherent to many AI-enabled initiatives and are part of how value is created and sustained.

Confidence in execution becomes as important as projected return. Outcomes depend on readiness across data, processes, people, governance, and integration; all of which influence how reliably value can be realized in practice.

Scalability and reuse play a significant role in shape long-term value. The impact of an AI investment is often determined by how easily a capability can be extended, replicated, or applied beyond the initial use case.

Risk also becomes multi-dimensional. AI initiatives can reduce certain operational, safety, or compliance risks while introducing new forms of dependency, exposure, or governance responsibility that need to be understood alongside potential benefits.

Workforce and operating model implications become more explicit. AI investments influence how work is done, how roles evolve, and how accountability is distributed, with implications that extend beyond the original business case.

Broader application and visibility also matter. AI-centric investments are more transformational when they are designed with the wider organization in mind. Leaders gain confidence when initiatives are visible, collaborative, and supported across functions, as this signals alignment and shared ownership rather than siloed execution.

These dimensions do not replace financial discipline. They broaden the lens through which AI-enabled investments can be fairly understood, compared, and ranked alongside more traditional capital initiative.

How Capital Ranking Changes When These Dimensions Are Included

When AI-enabled initiatives are evaluated across a broader set of considerations, capital rankings begin to shift. Options that previously appeared marginal or high-risk can become more compelling, while others lose relative priority once their full impact is visible.

Different types of initiatives surface as strong candidates. Foundational, enabling, or scalable investments often rank higher when their contribution to future capability and reuse is taken into account.

Trade-offs become clearer and more explicit. Leaders can see where they are choosing speed over resilience, efficiency over optionality, or near-term return over long-term capability, rather than making those choices implicitly.

Distinguishing between short-term and long-term value becomes easier. Decisions are no longer forced into a single time horizon, reducing pressure to overstate early benefits or underweight future impact that emerge over time.

Capital rankings begin to reflect intent as well as economics. Investments can be prioritized based on what the organization is deliberately trying to achieve, not just what is easiest to justify within a narrow financial frame.

As a result, decisions become easier to explain and defend. Rankings are supported by visible considerations rather than implicit judgement, improving confidence at executive and board level.

The outcome is not “better” decisions in hindsight. It is clearer, more deliberate decisions at the time they are made.

In practice, this may mean consciously accepting some operational risk by delaying replacement of legacy plant or equipment in order to prioritize investment in more transformational processes, such as automation or products that are increasingly AI-enabled.

A Simple Illustration: When the Same Investment Is Evaluated Differently

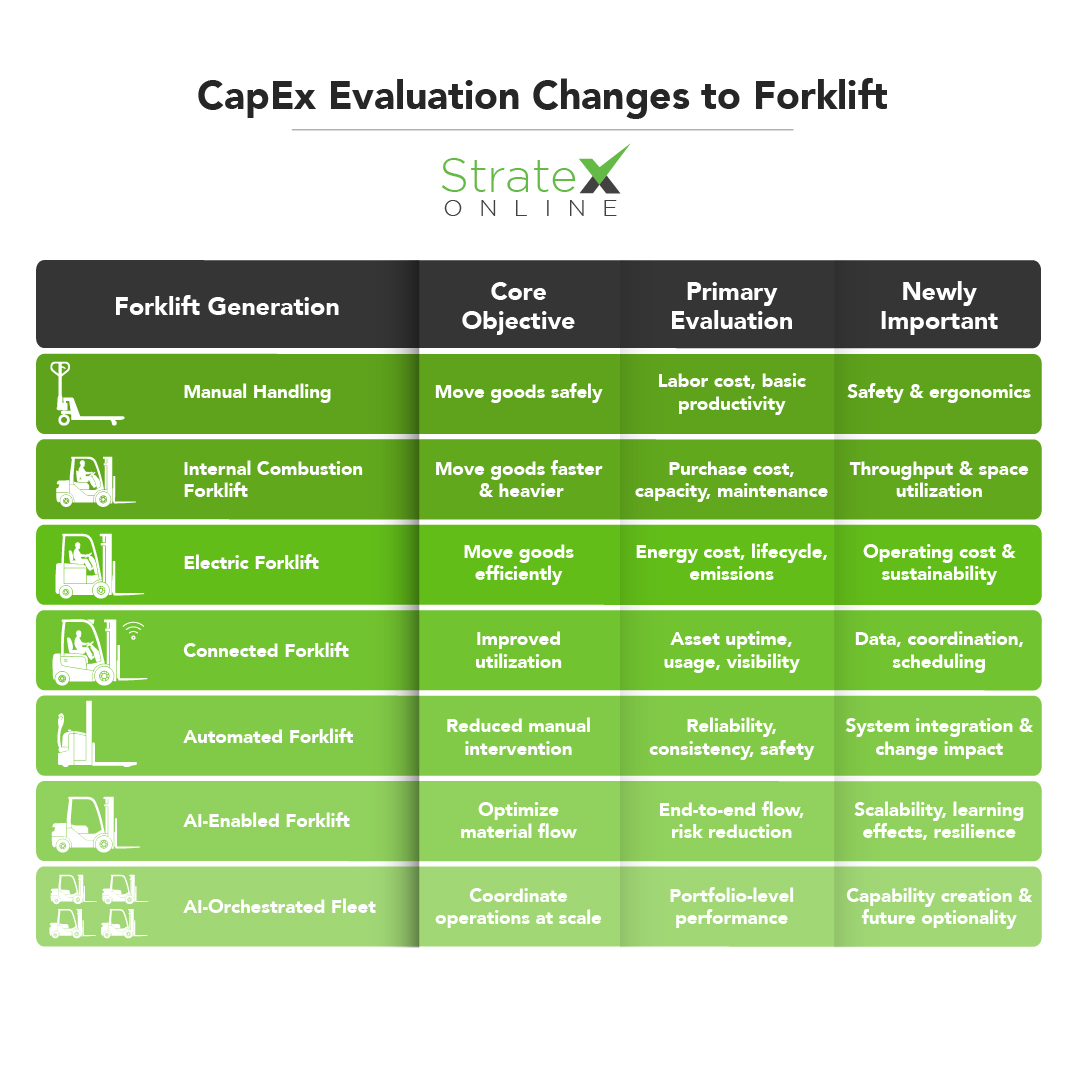

To make this shift tangible, consider a deliberately familiar example: the forklift. This is not a story about new technology, but about how capital project evaluation evolves as the nature of an investment change.

The underlying business objective has remained constant. Organizations have always sought to move goods safely, efficiently, and reliably within their operations.

What changes is not the objective, but how that objective is achieved. As the technology supporting forklifts evolves, the criteria used to evaluate the investment expand accordingly.

Each generation of forklift technology did not invalidate the evaluation logic that came before it. Instead, new considerations were added as the investment took on different characteristics and implications.

The inflection point occurs when intelligence, coordination, and autonomy are embedded. At that stage, the forklift ceases to be a standalone asset and becomes part of a wider operational system, with implications that extend beyond the equipment itself.

This pattern is not unique to forklifts. The same expansion in evaluation logic is occurring across many AI-enabled investments as they become more integrated, scalable, and system-wide.

The challenge, therefore, is not adopting new technology. It is recognizing when capital evaluation needs to evolve to keep pace with how modern investments actually behave. See how CapEx evaluation criteria changes as technology advances in the infographic below:

What Confident Capital Investment Decisions Look Like as AI Investments Become Standard

As AI-enabled initiatives become a routine part of capital portfolios, capital decision-making shifts from seeking certainty to building clarity. Leaders accept that not all outcomes can be predicted, but that better visibility supports stronger judgement at the point decisions are made.

Evaluation becomes a shared conversation rather than a functional handoff. Finance, operations, and technology leaders engage around the same investment decisions with a clearer understanding of trade-offs, dependencies, and implications.

Those trade-offs are made deliberately rather than implicitly. Choices between short-term return and long-term capability, efficiency and resilience, or speed and scalability are surfaced, discussed, and owned.

Capital rankings begin to reflect intent as well as economics. Investments are prioritized based on what the organization is deliberately trying to achieve, not simply on what is easiest to justify within narrow financial bounds.

Confidence comes from coherence, not precision. Leaders can explain why certain initiatives were prioritized, deferred, or sequenced in a particular way, even as outcomes evolve over time.

AI-enabled initiatives are treated as a normal part of capital planning. They are evaluated thoughtfully, compared fairly, and ranked alongside alternatives without hype or hesitation.

The result is not perfect foresight, but confidence in the decisions being made, based on the information and context available at the time.