In this article

- What is CapEx?

- The Difference Between CapEx and OpEx

- How to Calculate Capital Expenditure (CapEx)

- The CapEx Formula

- Practical Example of Using the CapEx Formula

- Calculating Other Types of Capital Expenditure

- Capital Expenditure Requests and Calculations

- Common Business Examples of CapEx

- 4 Key Benefits of Capital Expenditure

- A Summary on CapEx

In this article

- What is CapEx?

- The Difference Between CapEx and OpEx

- How to Calculate Capital Expenditure (CapEx)

- The CapEx Formula

- Practical Example of Using the CapEx Formula

- Calculating Other Types of Capital Expenditure

- Capital Expenditure Requests and Calculations

- Common Business Examples of CapEx

- 4 Key Benefits of Capital Expenditure

- A Summary on CapEx

Capital Expenditure, abbreviated as CapEx, is a financial term used to describe the capital investments that an organization makes into long-term projects. These capital investments aim to generate future income and broaden revenue streams, such as making investments into property, equipment, or technology. Capital expenditure is an essential component of financial planning, capital planning, and cash-flow management for organizations of all sizes.

In this article, we will define capital expenditure, highlight the differences between CapEx and OpEx, explain how to calculate CapEx, discuss why capital expenditure is important and beneficial to businesses, and explore everyday examples of capital expenditures.

What is CapEx?

Capital expenditure, or CapEx, is the money a company invests in acquiring, upgrading, or maintaining physical assets with the expectation of generating income over a long period of time. Capital expenditures are large investments that have a significant long-term impact on the organization’s financial health. There are subset types of capital expenditure such as maintenance and growth capital expenditure, which will be discussed more throughout this article.

Examples of CapEx

- The purchase of property

- The acquisition of a manufacturing plant

- Plant, property, and equipment (PP&E)

- Technology deployment

- Software licenses

- Furniture

- Patents

- Trademarks

Now, it is important to understand the difference between capital expenditure and operating expenditure. The misclassification of CapEx and OpEx can result in tax issues, inaccurate financial statements, and a loss of shareholder trust.

The Difference Between CapEx and OpEx

Capital expenses are long-term investments expected to generate income for an organization over a longer period of time. Whereas operational expenditures (OpEx) are short-term costs that are necessary to sustain day-to-day business operations. OpEx includes costs like utilities, laptops, and employee salaries, and rent.

The main difference between CapEx and OpEx is the timeframe in which they are capitalized, and their overall impact on financial statements.

CapEx are recorded on the balance sheet as assets and are depreciated or amortized over their useful life. On the other hand, OpEx is recorded on the income statement and is deducted from revenue to determine the company’s net income.

Let’s dive into examples of OpEx to distinguish these expenses further.

Examples of OpEx

The following examples of OpEx highlight common costs for day-to-day operations:

- Utilities

- Employee wages

- Laptops

- Office supplies

- Insurance

- Electricity

- Consulting fees

Understanding how to classify and budget CapEx and OpEx is essential for strategic CapEx decision-making. Capital expenditures are the foundation for future growth and sustainability; influencing a company’s long-term success. In contrast, efficiently managing operating expenditures ensures the smooth running of daily operations and can influence short-term profitability.

How to Calculate Capital Expenditure (CapEx)

Calculating capital expenditure helps organizations understand how much money has been invested in acquiring or upgrading long-term assets. The CapEx equation provides visibility into the Delta of PP&E, in addition to the cost of depreciating assets. PP&E is an important component of the CapEx calculation, where PP&E is simply an abbreviation for the capital expenditures associated with Property, Plant, and Equipment.

Therefore, the result of capital expenditure calculations reveal how much capital has been invested into annual maintenance and creation of fixed assets.

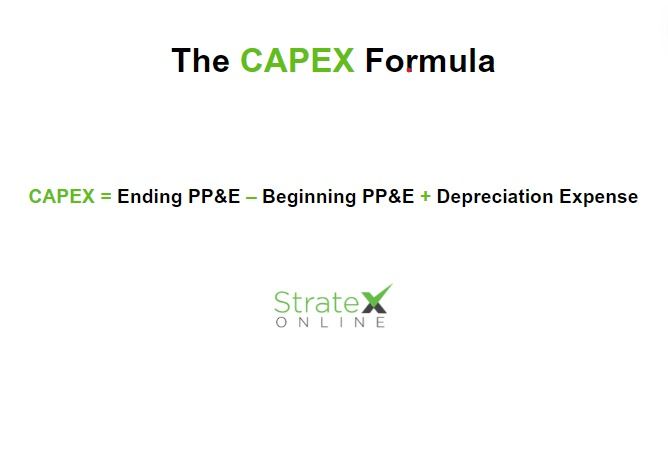

The CapEx Formula

The following formula is commonly used to calculate capital expenditure:

CapEx = (Ending PP&E – Beginning PP&E) + (Depreciation Expense).

Practical Example of Using the CapEx Formula

Let’s say an organization’s beginning capital assets for the year were $500,000, and their ending capital assets were $600,000. They also made additional capital investments of $100,000 during the year. Using the CapEx equation, we can calculate their capital expenditure:

CapEx = (Ending PP&E – Beginning PP&E) + Depreciation Expense.

CapEx = ($600,000 – $500,000) + $100,000.

∴ CapEx = $200,000.

The capital expenditure calculation reveals that the organization invested $200,000 in creating or maintaining fixed assets that year, which must be recorded on their balance sheet.

Calculating Other Types of Capital Expenditure

Let’s explore the two primary types or classifications of capital expenditures, Maintenance CapEx and Growth CapEx. Understanding and applying their equations will be necessary for your capital planning process.

Maintenance CapEx and Formula

Maintenance CapEx refers to any capital investment made to maintain or restore the existing productive capacity of an asset. These are investments in capital assets that are necessary for ongoing operations and to sustain the asset’s current level of performance. While maintenance expenses are often treated as operating costs, maintenance CapEx involves significant expenditures that are capitalized on the balance sheet because they contribute to the long-term value of the asset.

Maintenance capital expenditure is typically calculated by considering the depreciation expense and any additional capital expenditures required to maintain existing assets.

The Maintenance CapEx Equation

Maintenance CapEx = Depreciation Expense + Capital Expenditures for Maintenance.

Examples of Maintenance CapEx

- Maintenance of property, plant, and equipment (PP&E)

- Updates to technology and software systems

- Maintenance of utilities and infrastructure

- Maintenance of production lines

- Safety equipment

- Replacement of parts and components

Growth Capital Expenditure and Formula

Growth CapEx is calculated by evaluating the capital expenditures made to support the growth of the business, such as investments in new projects, expansions, or acquisitions.

What is Growth CapEx?

Growth CapEx is a specific type of capital expenditure focused explicitly on investment initiatives designed to expand the business, increase capacity, or pursue new growth opportunities. While all growth capex is a type of capital expenditure, it’s important to note that not all capital expenditures are growth related.

The Growth Capital Expenditure Formula

Growth CapEx = Total Capital Expenditures − Maintenance Capital Expenditure.

Growth CapEx Examples

- Building new manufacturing plants.

- Buying or acquiring existing businesses.

- Buying new property.

- Buying new equipment such as cutting-edge machinery.

- Investing in research and development (R&D).

- Upgrading technology to support business expansion.

Make sure you explore capital project types and how to classify them. Nonetheless, let’s discuss how to calculate capital expenditure and how to use the capital expenditure formula.

Capital Expenditure Requests and Calculations

A capital expenditure request (CER) is a form used to request approval for capital expenditure to be budgeted towards a capital project. The capital expenditure request form includes details such as the purpose of the expenditure, the expected benefits, and the estimated cost. By using a standardized capital expenditure request form template, organizations can ensure that all information is provided and that proper evaluation takes place before capital project approval.

Capital expenditure requests must use consistent, reliable, and accurate CapEx equations to succeed, which is why standardized templates are so important. By harmonizing capital expenditure approval software with capital expenditure request forms, organizations can ensure that capital investments are consistently calculated, evaluated, and approved before being actioned.

Common Business Examples of CapEx

Let’s explore three common examples of capital expenditure in business:

- Property, Plant, and Equipment (PP&E),

- Technology Upgrades,

- Intangible Assets.

1) Property, Plant, and Equipment (PP&E)

One of the most common examples of CapEx is the purchase of property, plant, and equipment (PP&E). PP&E are expected to generate income for the organization over a period of time and is recorded on the balance sheet as assets. They are depreciated or amortized over their useful life, which reduces their value on the balance sheet over time.

Examples of PP&E

- Purchasing real estate or a new office.

- Purchasing manufacturing equipment.

- Investing in vehicles for transportation.

- Investing in a new manufacturing plant.

2) Technology Upgrades

Organizations invest in new technology or software to improve their processes, increase productivity, or stay competitive in their industry. This could include an ERP implementation such as SAP.

Technology as a Capital Expenditure

All technology upgrades made by a business are incurred as capital expenditures, including software upgrades. Technological acquisitions or upgrades are recorded as assets on the balance sheet. Additionally, it’s important to note that software licenses are a common form of capital expenditure.

Learn how to effectively distinguish between CapEx and OpEx with SaaS projects.

3) Intangible Assets

Intangible assets are also expected to generate income for the organization and are recorded on the balance sheet as assets. Intangible assets are amortized over their useful life, which can range from a few years to several years, depending on the type of asset.

Examples of Intangible Assets

- Patents.

- Trademarks.

- Copyrights.

- Research and development.

- Intellectual property.

- Software licenses.

4 Key Benefits of Capital Expenditure

Capital expenditure is an essential aspect of financial planning and budgeting for organizations with numerous benefits. It allows companies to invest in long-term assets that will generate future income and contribute to the growth and success of the business.

Let’s discuss 4 key reasons why capital expenditure is important to all organizations and the key benefits.

1. Future Growth and Income

Capital expenditures produce extensive long-term benefits and contribute to the growth and expansion of the business. By investing in a long-term asset, organizations can expand their operations, increase production, and generate higher future cash flows. This is especially important for organizations that are looking to grow and stay competitive in their industry.

2. Asset Maintenance and Upgrades

Capital expenditures also include the costs of maintaining and upgrading existing assets. This is important for businesses that rely on equipment or technology to operate. By investing in the maintenance and upgrades of these assets, organizations can ensure their continued functionality and avoid capital project failure.

3. Tax Deductions

CapEx can also provide tax benefits for organizations. In many cases, these capital investments can be deducted from the organization’s taxable income, reducing their tax liability.

4. Attracting Investors

Investors often look at a company’s capital expenses as a sign of future growth and potential. By investing in long-term assets, companies can show investors that they are committed to the success and growth of their business.

A Summary on CapEx

CapEx is the beating heart of capital planning, enabling companies to sustain and maintain growth through multi-year capital investments. These capital investments generate fixed assets that are expected to generate income, typically over the period of a few years. Capital expenditure has numerous strategic benefits from taxation to generating stakeholder interest; making it important to the overall success of any organization.

Understanding capital expenditures and their importance in business enables organizations can make well-informed business decisions. This includes prioritizing capital investments, choosing optimal capital projects, enhancing cash flows, and contributing to the growth and success of their organization. Identifying the difference between capital expenditure and operational expenditure is important, so I encourage you to learn the difference between CapEx and OpEx for SaaS projects.